It’s a New Year…But Is It a New Housing Market?

We’ve all been reading the conflicting headlines. Some say 2010 will have its challenges. Others say 2010 will be the start of good things to come. But what’s the truth? How can we read through the pessimism and for that matter, the rose colored glasses, to determine where we are likely headed?

In 2009, it seemed the only thing that was “certain” regarding the economy, financial markets and real estate in 2009 – was uncertainty.

We’re hoping much of that is behind us, and here I’ll offer my insight and share what I believe the coming year will bring. Together, we’ll weed through the headlines and I’ll offer my best opinion. And a year from now, we’ll look back on this edition of Weekly Market Watch to determine if my hunch was correct or if I should’ve kept my opinions with the rest of the weeds.

· Overall. I think 2010 will be the year we begin to build a solid housing foundation. Many experts are predicting that the recession is nearly complete, if it isn’t already, as measured by a decline in negative growth. But the recovery is going to depend somewhat on stimulus spending (much of which is already approved and unspent) and doing more to facilitate job growth. As CAR Economist Leslie Appleton Young said, “If we don’t create more direct policies to get people back to work, this could go on much longer.”

· Let’s start with foreclosures. No, we are definitely not out of the woods yet. I think we have a lot of work ahead of us and much of that has to do with the state of the overall economy. Unemployment is still high and while I think we’re better, we’re not yet on enough solid ground to be able to say that 2010 will see the end of broad-based job loss. Late in 2009 we’ve seen some consecutive weeks of declining new unemployment claims, which could be a good start. The latest U.S. Bureau of Unemployment Figures show that unemployment rates were higher in November 2009 than for the same period in 2008 in all 372 metropolitan areas. What happens when people lose their jobs? They typically aren’t able to pay their mortgages. There are also many people out there with adjustable rate mortgages which haven’t yet adjusted. When those mortgages adjust, there will be people who will find themselves in a short sale or foreclosure situation, especially if their employment situation is not as favorable as it was when they originated their home loan. Fortunately the good news is that the government is putting more pressure on banks to work with homeowners on modifying their existing loans. There are also some banks who are taking steps to clear the way for a Short Sale approval if a modification request can’t be approved. These programs can help avoid too many foreclosed properties hitting our markets in too short a period of time. There is talk of even more creative programs that could ease the level (or velocity) of foreclosures - which simple Econ 101 tells us is coming.

· Interest rates. There are many schools of thought with relation to the future of interest rates. I tend to agree with economists who believe that last year’s record low interest rates, where some were able to secure a 30 year fixed rate mortgage for under 5%, may be a thing of the past. Do I see them taking a big surge upward in 2010? No, probably not. CNBC Reporter Diana Olick wrote, “Unless the government decides to extend its Fannie-Freddie purchase program or do something else to juice the credit markets, mortgage rates will rise steadily, probably leveling off somewhere around six percent” and I tend to agree with that. Also, from Lawrence Yun, NAR Chief Economist: “The Federal Reserve will slowly start the unwinding of its mortgage-backed security purchases. Also, consumer prices will be watched for any sign of accelerating inflation. Bond investors, therefore, will be cautious about lending at such low rates. The 30-year fixed rate is likely to reach 5.7 percent by the end of 2010 from the current 5.0 percent.” Still a good place to be. But having said that, I encourage you to review my February 2009 Reality Check piece in which I shared how increases in purchasing power can affect a buyer’s purchasing power. I have updated it with the latest numbers and if you are considering buying, you may want to consider doing so before interest rates start making their way up. Even a small hike in rates can dramatically affect your purchasing power.

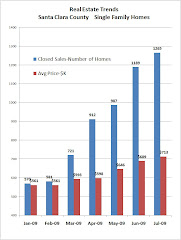

· Housing Prices and Sales. I tend to agree with the California Association of Realtors price and sales outlook for 2010. They’re calling for a 3.3% increase in median home price. They’re also calling for a 2.3% decline in home sales. I think these are accurate predictions. In the Bay Area we will have pockets that could vary as much as 5% to 8% in either direction – but I will say that we’ll see the Bay Area remain fairly flat with respect to price and units as a whole.

· The hottest market? The entry level market is by and large the hottest segment of the housing market right now and in all honesty, probably will continue to be in 2010. But, it was also the first to experience the downturn so it is certainly easy to suspect that it would be the first to recover. What we know about the entry level market is this:

o Homes saw a great deal of depreciation in this market

o This market was most affected by foreclosures and short sales

o Affordability is especially high in this market

o The inventory is low in the entry level market in many areas

I don’t see much of this changing in 2010.

I do see a trickle-up affect coming from the entry level market into the move-up market. We are beginning to see contingent offers, more and more each week. Some homeowners are able to take advantage of the $6,500 home buyer tax credit as well as the opportunity to cash in on a buyer’s market in the entry level and a seller’s market in the move-up region. It really is a perfect storm for this group and I hope more move-up buyers will consider that. Fortunately, we have our Move-Up Marketer program which helps to educate move-up buyers about the opportunities in today’s market.

The luxury market is a very different market indeed. It was the last to be affected by the market changes and in all likelihood it will be the last to recover. Having said that, there are some very interesting pockets of success. It really depends on the house, the neighborhood and the overall demand for that particular market. We’ve seen instances where a million dollar home comes on the market only to be snatched up within a few days, while others nearby are sitting for over 120 days. It really comes down to location, condition and pricing—no real surprise there! Luxury homes over $2.5M are least affected by interest rates and availability of loans – but can be more largely impacted by movement of the Dow and international economic markets. I would say watch where the Consumer Confidence Index and the DJI is going, and your Luxury market is probably not far behind.

In the end, regardless of what the market may or may not be in the coming year, the bottom line is, it may be a really great time to buy. Attractive interest rates. Increased affordability. Tax credits. In many instances, there hasn’t been a better opportunity to buy in decades. Please don’t lose sight of that. If you are in a position to buy and are considering do so, please do explore your options. I believe 2010 will be a year of creating a solid foundation on which to build. Don’t wait until it has passed by.

Monday, January 11, 2010

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment