Stimulus Programs and Interest Rates

Since Thanksgiving interest rates have dropped a full point to 5.5% on thirty year loans up to $625k. Rumors of additional reductions to 4.5% are being considered for home purchases only (no refinancing) and for loans only up to $417k. These won’t be finalized until after the inauguration.

There are currently considerable incentives to buy down the rates. One point may get you a 1% lower rate.

Since the mortgage market is changing weekly, if you want current news, please call me.

Conforming Loan Limits:

Mortgage Loan limits for conforming (non-Jumbo) loans have increased. In the past, any loan over $417,000 was considered a Jumbo Loan and had higher interest rates. In 2009 the conforming limits will be $625,000. This is true for both new loans and refinanced loans. (This limit was temporarily increased to $729,500 until the end of 2008.). With the increased loan limits, historically low loan rates, and incredible opportunities in the market, this is an excellent time to buy a home at a very enticing price and terms.

Capital Gains Tax Exclusion on the Sale of your Home:

There are also changes to the capital gains tax exemption on the sale of your home. The rules allow for an exemption of $250,000 per person (or $500,000 if filing jointly) for a home lived in as a principal residence for two of the previous five years. For most people selling their homes, there will be no change from what has been the law for nine years. In the past, however, even if the home was occupied as a rental property for the remaining three years, you could still claim the full $250,000 ($500,000) deduction to your capital gains. Starting in 2009, the deduction will be pro-rated based on the percentage of time the home was actually used as your principal residence. Using the above example, your exemption could be reduced by as much as 60%. Furthermore, if the property was involved in a prior 1031 exchange before this sale, there are additional new limitations and restrictions on your write-off.

Please consult with your tax advisor to determine your best options. Meanwhile, if you or a friend is thinking of buying or selling a home, or simply has a real estate question, please call me. I will give you the respect and professional service you deserve.

Tuesday, December 9, 2008

Monday, November 10, 2008

Real Estate Update, October 2008

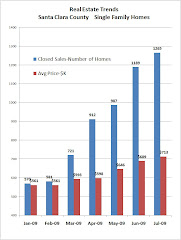

With an abundance of foreclosure, bank-owned, and short sale properties on the market in Santa Clara County, closed sales of single family homes in October were up 37% from October 2007.

Of the 5,100 single family homes on the market, over 42% are distressed Bank-owned or short sales.

Of the closed sales in October priced OVER $750k, the number of units sold were down 34%, and the median price of $998k was down a mild $8% from October 2007

Of the closed sales in October priced UNDER $750k, the number of homes sold were up 180%, and median price of $471k was down 28% from October 2007.

Of the 5,100 single family homes on the market, over 42% are distressed Bank-owned or short sales.

Of the closed sales in October priced OVER $750k, the number of units sold were down 34%, and the median price of $998k was down a mild $8% from October 2007

Of the closed sales in October priced UNDER $750k, the number of homes sold were up 180%, and median price of $471k was down 28% from October 2007.

Monday, May 12, 2008

May 2008 Real Estate Trends

THE WEATHER AND MARKET ARE GETTING HOTTER:

After a slow start in 2008, sales of single family homes have increased dramatically, thanks to the new FHA loan limits and the large inventory of great buys currently on the market in Santa Clara County.

Statistics:

Santa Clara County sales are down year-over-year, and the median price of a single family home in the first quarter of 2008 is down 1% from 1st quarter 2007 and down 7% from the average median in 2007.

However, new sales contracts in February and March were the highest since mid 2007, and in April, new sales contracts of over 1100 were the highest since May of 2006. These positive numbers will be reflected in news reports after they close escrow 4-6 weeks from now.

Interest Rates:

The highly publicized stimulus plan for new conforming rates which raised the jumbo loans to $729k has been slow to materialize in better rates until May 8, when the new conforming rate for 30 year loans came down to 6%. The new FHA loans are allowing 90% and 95% loans for credit worthy buyers which is impacting the low and middle end of the market and is why new sales in April were so high. Now with the other rates coming down, the mid to higher parts of the market should take off.

Inventory:

Inventory of single family homes always increases in the spring and this year is no exception. It is just starting from a much higher base, and the resulting inventory of single family homes is the highest in over 6 years, although there are signs it is leveling and will certainly cycle down by the fall as it always does.

In late march, inventory of Condos and Townhomes matched the highs of last year but have leveled and may be declining slightly in recent weeks.

Overall Assessment:

Prices have adjusted downwards; interest rates have stayed quite moderate and are getting better. This is the time for smart buyers to beat the crowd and get a great home at a great price. If you are getting ready to sell your home, price your home competitively and be sure it shows well.

After a slow start in 2008, sales of single family homes have increased dramatically, thanks to the new FHA loan limits and the large inventory of great buys currently on the market in Santa Clara County.

Statistics:

Santa Clara County sales are down year-over-year, and the median price of a single family home in the first quarter of 2008 is down 1% from 1st quarter 2007 and down 7% from the average median in 2007.

However, new sales contracts in February and March were the highest since mid 2007, and in April, new sales contracts of over 1100 were the highest since May of 2006. These positive numbers will be reflected in news reports after they close escrow 4-6 weeks from now.

Interest Rates:

The highly publicized stimulus plan for new conforming rates which raised the jumbo loans to $729k has been slow to materialize in better rates until May 8, when the new conforming rate for 30 year loans came down to 6%. The new FHA loans are allowing 90% and 95% loans for credit worthy buyers which is impacting the low and middle end of the market and is why new sales in April were so high. Now with the other rates coming down, the mid to higher parts of the market should take off.

Inventory:

Inventory of single family homes always increases in the spring and this year is no exception. It is just starting from a much higher base, and the resulting inventory of single family homes is the highest in over 6 years, although there are signs it is leveling and will certainly cycle down by the fall as it always does.

In late march, inventory of Condos and Townhomes matched the highs of last year but have leveled and may be declining slightly in recent weeks.

Overall Assessment:

Prices have adjusted downwards; interest rates have stayed quite moderate and are getting better. This is the time for smart buyers to beat the crowd and get a great home at a great price. If you are getting ready to sell your home, price your home competitively and be sure it shows well.

Thursday, March 13, 2008

MARKET UPDATE, MARCH 14, 2008

News:

The new FHA loan limits approved by HUD includes Santa Clara County. The new loan limits for FHA, Fannie Mae and Freddie Mac increased to the $729,750 cap. What does this mean for the Northern California real estate market? Increased opportunity for new and existing home buyers. The purpose of this increase in loan limits is to assist individuals who currently have “jumbo” loans (greater than $417,000) to refinance into lower and more affordable rates and payments. With the traditionally strong spring market, the new loan limits are expected to revive the Northern California market.

County Statistics:

For the first two months of 2008, the Santa Clara median price of single family homes was $761k, almost identical to the same period last year. Average prices actually increased 4% to $995k. On the negative side, the number of closed sales in the two month period was down 43% and the average time on the market increased 16% to 84 days.

The new FHA loan limits approved by HUD includes Santa Clara County. The new loan limits for FHA, Fannie Mae and Freddie Mac increased to the $729,750 cap. What does this mean for the Northern California real estate market? Increased opportunity for new and existing home buyers. The purpose of this increase in loan limits is to assist individuals who currently have “jumbo” loans (greater than $417,000) to refinance into lower and more affordable rates and payments. With the traditionally strong spring market, the new loan limits are expected to revive the Northern California market.

County Statistics:

For the first two months of 2008, the Santa Clara median price of single family homes was $761k, almost identical to the same period last year. Average prices actually increased 4% to $995k. On the negative side, the number of closed sales in the two month period was down 43% and the average time on the market increased 16% to 84 days.

Tuesday, February 5, 2008

Market update - Feb 5, 2008

Inventory leveled off and sales remained steady as of the first week of February. Interest rates are lower, and the expected change in conforming rates for California should greatly improve the market. With the change, federal guaranteed 30 year loans of up to $729k will be available at rates of 5.75%, or about what the 5 year adjustable rates are now.

Lenders advise buyers to update your loan approvals letters now. If they are over 2 weeks old they will need updating.

A rush is expected once the new legislation is passed, which is expected by mid February.

Bill Sumits

Lenders advise buyers to update your loan approvals letters now. If they are over 2 weeks old they will need updating.

A rush is expected once the new legislation is passed, which is expected by mid February.

Bill Sumits

Subscribe to:

Posts (Atom)