As we move into the New Year, it is a good time to assess how the Bay Area housing market fared in 2010 and what we may expect in 2011.

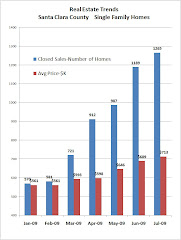

2010 picked up where 2009 left off as many homebuyers rushed to take advantage of the expiring federal tax credit, as well as capitalize on historically low interest rates and outstanding home prices. Our Bay Area housing market, as well as others across the nation, enjoyed fairly healthy gains in unit sales and the median sales price in the first part of the year. However, with the expiration of the homebuyer tax credit and continued sluggishness in the economy, the market cooled off considerably in the second half of 2010.

While the overall market moved in fits and starts in 2010, the luxury market – those homes priced at $1 million or $2 million and above depending on the city – quietly turned in a very strong year, according to our own monthly Coldwell Banker Residential Brokerage luxury market reports. In Silicon Valley, for example, eight of the past 10 months have seen luxury home sales rise year over year.

While the Bay Area has not been immune to the challenges facing the nation’s real estate market, we generally fared better than many other parts of California and the nation.

So what does this mean as we head into 2011? The California Association of Realtors in its 2011 housing market forecast predicted that the golden state should see a modest 2 percent increase in sales to 502,000 homes in the coming year. And after two consecutive years of record-setting price declines, the median home price in California will climb 2 percent in 2011 on top of this year’s 11.5 percent rise, according to the CAR forecast.

“California’s housing market will see small increases in both home sales and the median price in 2011 as the housing market and general economy struggle to find their sea legs,” said CAR President Steve Goddard.

While there are certainly challenges ahead, the upcoming year may create an opportunity trifecta for buyers: Continued historically low interest rates, extremely affordable housing prices, and plentiful inventory in most price levels. We haven’t seen this combination in many years.

The caveat is that there is no guarantee that mortgage rates will remain where they are today. In fact, in recent weeks, we have seen rates increase as the 10-year and the 30-year Treasury bill rates edge upward. And even a one-percentage point increase on a $500,000 mortgage can add several hundred dollars to a monthly payment. But for now, the rates are still extremely low by historic standards.

Additionally, the nation’s economy continues to grow, albeit slower than many of us would like. But corporate earnings have come back quite strong this year, which could bode well for employment growth in the New Year.

Finally, a compromise in Washington that extended the President Bush-era income, dividend and capital gains tax cuts for two more years will hopefully bolster the housing market.

So while it is not likely to be the best year that we have ever had in real estate, I am cautiously optimistic that by this time next year we will look back at 2011 as a very nice turning point for the Bay Area housing market.

Wednesday, February 9, 2011

Subscribe to:

Posts (Atom)